With the easing of pandemic restrictions and an ever-increasing vaccination rate, the US economy is poised for a tremendous rebound in 2021 and beyond. This means positive things for the legal sector, particularly the areas of practice that were disrupted by the COVID-19 outbreak.

New data is coming in, both from Google and Scorpion’s own internal metrics, that point to a heightened need for legal work in the coming months. To better prepare your firm for a possible uptick in cases, let’s look at the numbers and see how they can inform your plans for growth and marketing heading into the summer.

Consumer Trends in Immigration

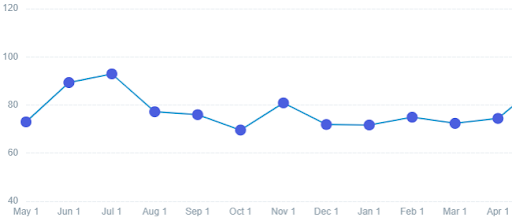

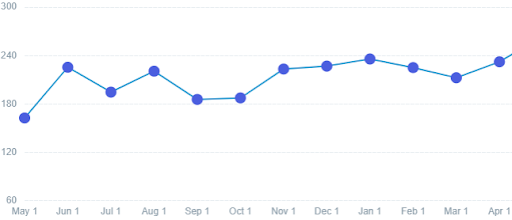

Interest over the last 12 months for "Immigration Lawyer" (Google Trends)

Regarding search interest for immigration law, April ended up being a relatively slow month. It was the slowest of the year so far. But to put it in proper perspective, interest was still higher in April than other months in 2020. Fortunately, there was a noticeable uptick in volume at the start of May, and this trend may continue throughout the remainder of the month. News that the Biden administration is planning to revive the International Entrepreneur rule is also reason to think that interest in immigration law will continue to rise.

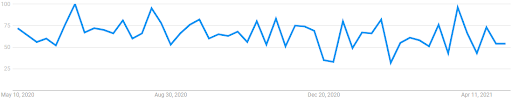

CPL trends over the last 12 months (Scorpion Data)

Clicks-Per-Lead (CPL) went up slightly in April, after a full year of consistent performance. The increase in CPL is likely due to the recent drop in volume. But, with volume going back up, we should see CPL improve as well. Additionally, this past month, Scorpion generated 123 more leads compared to April of last year!

Employment Law

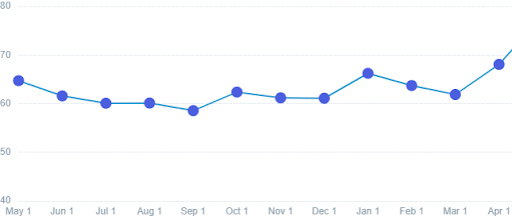

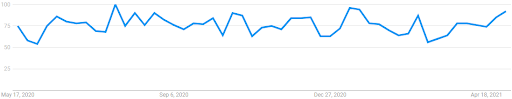

Interest over the last 12 months for "Employment Lawyer" (Google Trends)

At the beginning of last month, we were starting to see some steadiness in employment law, but search interest is still all over the place, as you can see above. April saw volume that stayed in line with previous months, with a slowdown initially and a spike to close the month out. The team at Scorpion expected volume to already be stabilized since most businesses are now open (at least with limited capacity or service), but we may not see that for another few months.

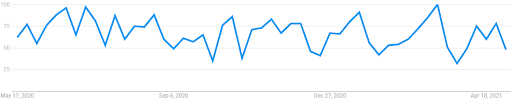

CPL trends over the last 12 months (Internal Data)

Unfortunately, last month we saw our highest CPL for employment law in the previous year. Click costs went down in April, but our conversion rate also went down, which caused the sudden spike in CPL. Considering that the last three months saw consistent improvement, we see April CPL as an anomaly and not what is expected moving forward. The team at Scorpion will keep an eye on this and make sure we are doing everything we can to make lead costs more affordable in the next few months.

Bankruptcy

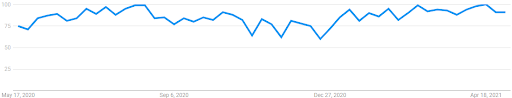

Interest over the last 12 months for "Bankruptcy Lawyer" (Google Trends)

After the huge dip in volume in March, we saw solid improvement in April. Government aid is still the primary reason for poor search volume surrounding bankruptcy law. We likely won't see more interest until federal financial support has been exhausted. According to the American Bankruptcy Institute, bankruptcy filings saw a major surge in March. This trend isn’t reflected in the data above, but it does provide some insight on the direction of the market. It's also interesting to note that despite the low search volume in March, filings were still up.

CPL trends over the last 12 months (Internal Data)

Bankruptcy also saw a CPL spike in April. As with Employment law, we have been seeing steady improvement since January, so we also expect this to be an anomaly rather than the norm. Unfortunately, it may be some time until we get back to the CPLs we saw before the pandemic.

Estate & Probate

Interest over the last 12 months for "Estate Planning" (Google Trends)

Interest over the last 12 months for "Probate" (Google Trends)

Estate planning is seeing another terrific surge right now after a fairly long plateau, and probate search interest has remained consistently high since December. One possible reason for the uptick in overall volume for these verticals could be the higher interest from people within the age range of 18-34. Caring.com put together an interesting survey that found that young adults are now more likely to have a will than middle-aged adults due to the experience of COVID-19.

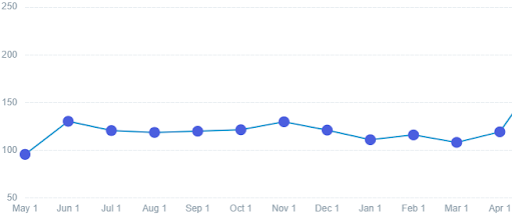

CPL trends over the last 12 months for Estate AND Probate (Internal Data)

April CPL increased for the estate and probate law, but both verticals are still doing much better than last year. Click costs went up a bit, and conversion dipped slightly, which caused the increase in CPL the previous month. With search volume being as high as it is now, we at Scorpion expect that CPL will go back down during this month.

Learning from the Data

The information provided above only scratches the surface of what can be gleaned through a thorough analysis of the digital data available from Google and marketing partners like Scorpion. We hope that you can take the figures we’ve presented here and use them to inform your practice’s business and marketing strategies in the coming months.

If you have any questions about the consumer trends sweeping the legal industry or anything else related to your firm and its growth potential, please contact us or call 844-505-4349.